SVB - Black Swan event or the Calm Before the Storm?

For years, SVB or Silicon Valley Bank has been the go-to for startups, venture capitalists, and private equity and hit highs of over $750 merely one year ago which resembles a 660% increase from its current halted price of $106. This can be visualized in Figure 1 below:

Figure 1: SVB Two Year Price Action

As seen in Figure 1, SIVB has been in a steady decline ever since late 2021. Even before the halt on Thursday, the share price had slipped a staggering 65% before dropping 60% again but this time, it was in a single day.

So what went so wrong? Simply put, SBV is a bank, so they acted how banks act. They invested their client money and invested diversely in bonds, mortgages, and US government debt. However, due to the Fed’s constant rate hikes, their investments started to crack. Simultaneously to their investment pickle, their customers were demanding withdrawals. Being stuck between a rock and a hard place, SBV had no other choice but to sell their bonds and a huge loss to satisfy their customer’s withdrawal requests. As a result, similar to the 2008 crisis, fear ensued which magnified the situation and caused the run on the bank which essentially means when too many people request the withdrawal of their money simultaneously. This was warranted due to the fact that banks only insured up to 250k, anything over that (which most accounts exceeded) was not ensured.

On Wednesday last week, SVB sold a $21 billion bond portfolio which consisted predominantly of U.S treasuries. That portfolio was only yielding an average of 1.79% which was positioned well below the 10-year yield of 3.9%. This translated into a 1.8 billion loss which needed to be rectified through a means of capital raise. To avoid a complete repeat of 2008, congressman Jess Jackson took to tik tok of all places to state that “all the depositors will be made whole and will be paid through the fund that banks pay into, not taxpayer money.” He then went on to say “we’re not protecting management or people that own stock in the bank.”

An interesting point is that Greg Becker sold 12,451 shares on Feb 27th tototaling3.6 million which he managed to sell for an average of $287.42… but we won’t get into that as it’s probably just a coincidence…

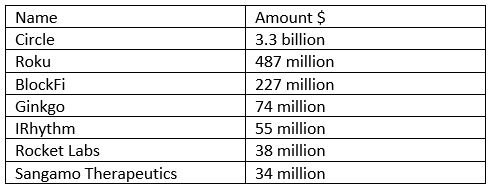

Figure 2 was compiled from Twitter user @GRDecter and outlines just how much exposure some companies had. This is worrying for some of these companies due to the fact that even if they are perceived as being a relatively ‘healthy’ company, the limitations imposed by their bank (SVB) could result in the potential of not being able to satisfy payroll obligations. However, this is no longer considered to be a major concern as on Sunday the US Treasure issued a statement explaining that “Depositors will have access to all of their money starting Monday, March 13.”

Thanks to the quick intervention of the Fed, the snowball effect has stopped right at the beginning however, the question remains - is this just a black swan event, or is it the calm before the storm?

Disclaimer

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation, or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves the risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.